Key performances

Robust progress on strategy

In 2021, we continued to make good progress against our strategic and financial ambitions. We made an important step towards sustainable top-line growth and the efforts made in customer satisfaction are bearing fruit, as illustrated by customer satisfaction improvements in both Business and Consumer.

Financial key performances

Adjusted EBITDA AL 1, 2

€ millions

- 2019

- 2,317

- 2020

- 2,320

- 2021

- 2,347

Capital expenditure 1

€ millions

- 2019

- 726

- 2020

- 765

- 2021

- 784

Free cash flow growth 1

€ millions

- 2019

- 1,115

- 2020

- 1,147

- 2021

- 1,216

Commited to progressive dividend policy

€ cents

- 2019

- 12.5

- 2020

- 13

- 2021

- 13.63

Return on capital employed 4

- 2020

- 10.1%

- 2021

- 11%

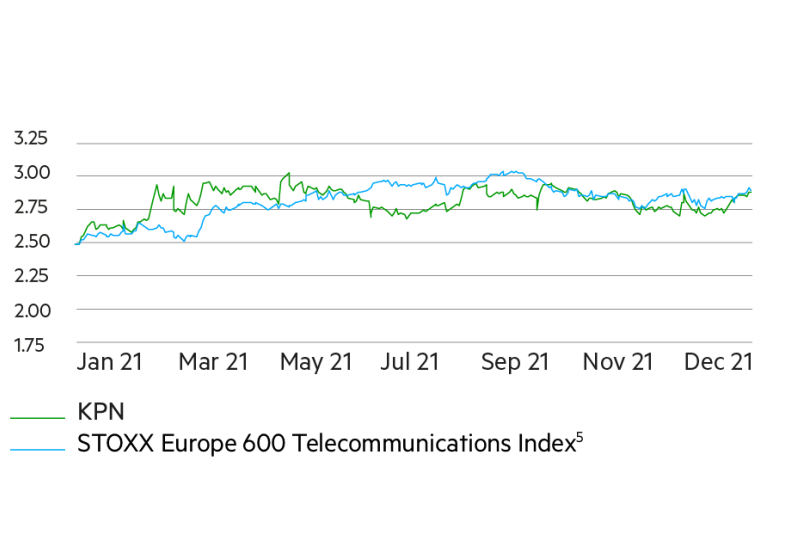

Total Shareholder Return (TSR) 5

- Telco index 2021

- 16.2%

- KPN 2021

- 15.1%

Non financial key performances

Network infrastructure

# FttH households

- 2019

- 2.47m

- 2020

- 2.78m

- 2021

- 3.22m

Network infrastructure 6

Sites 5G ready

- 2019

- 641

- 2020

- 2,936

- 2021

- 4,000

Network speed

Average maximum download speed broadband fixed per year-end (Mbps)

- 2019

- 236

- 2020

- 377

- 2021

- 446

Network speed

Average 5G download speed mobile network per year-end (Mbps)

- 2021

- 210

Energy consumption in petajoules

Energy consumed By KPN

- 2019

- 2.728

- 2020

- 2.428

- 2021

- 2.132

Energy consumption in petajoules 7

Estimated energy consumption saving by KPN customers

- 2019

- 3.437

- 2020

- 9.8022

- 2021

- 6.588

B2C products and services

Fixed-mobile households as percentage of fixed households

- 2019

- 52%

- 2020

- 53%

- 2021

- 54%

B2C products and services

Postpaid customers

- 2019

- 3.588m

- 2020

- 3.584m

- 2021

- 3.647m

B2C products and services

RepTrak Reputation score

- 2019

- 74.4

- 2020

- 76

- 2021

- 74.4

Strategy

Connecting the Netherlands through fiber

Fiber footprint KPN

- 2019

- 31%

- 2020

- 35%

- 2021

- 40%

5G coverage Dutch population

Population coverage

- 2021

- 81%

Connecting the Netherlands through fiber

Scaling up roll-out to 9k on average per week

- 2019

- 2k

- 2020

- 6k

- 2021

- 9k

Consumer

Stable customer base: household

- 2020

- 3.55m

- 2021

- 3.53m

Business

Stable to growing customer base: Mobile, Broadband, VoIP, Fixed voice

- 2019

- 2.9m

- 2020

- 3.1m

- 2021

- 3.2m

Consumer

Customer satisfaction

- 2019

- 19

- 2020

- 11

- 2021

- 16

Business

Customer satisfaction

- 2019

- -4

- 2020

- -2

- 2021

- 4

New ways of digital working

Employee engagement

- 2019

- 77%

- 2020

- 86%

- 2021

- 82%

Continued disciplined cost control program

Indirect cost reduction (€)

- 2019

- 141m

- 2020

- 137m

- 2021

- 47m

1. Based on continuing operations

2. KPN defines EBITDA as operating result before depreciation (incl. impairments) of PP&E and amortization (incl. impairments) of intangible assets. Adjusted EBITDA after leases are derived from EBITDA and are adjusted for the impact of restructuring costs and incidentals (‘adjusted’) and for lease costs, incl. depreciation of right-of-use assets and interest on lease liabilities (‘after leases’ or ‘AL’). Reconciliations can be found in Appendix 1

3. To be proposed at the AGM on 13 April 2022

4. Net operating profit less adjustments for taxes divided by capital employed

5. Rebased to KPN’s closing price of the last trading day of 2020

6. Restated number including replacement sites and densification sites

7. Restated due to updated calculation method